Part 2: Should you open new clinics to fuel growth?

Considerations and financial projections of an organic growth strategy

Picking up where we left off, in Part 1, we “bought” an illustrative, largely cash-pay PT business and discussed the importance of revenue growth to create value. Here, we’ll explore what organic revenue growth for this business means strategically and financially.

Quick commentary on cash-pay PT

The PT industry overall generates $50B in revenue annually, is growing at 3%, and has 125K businesses[1]. It’s unclear what portion of the market is cash-pay, but there’s reason to believe cash-pay PT will expand.

Supply-wise, declining insurance reimbursement is the top concern shared by PT professionals, and nearly 80% of PTs have or plan to offer cash-pay services in response[2]. Some hospitals have even started to open cash-pay “performance clinics”[3]. Demand-wise, thanks to high-deductible plans and HSAs, patients are slowly becoming more informed “buyers” of healthcare and more accustomed to paying cash out-of-pocket (e.g., copays). Altogether, cash-pay PT continues to emerge and legitimate tailwinds are driving growth, but also increasing competition.

Quick organic growth strategy overview

Listed in order of increasing complexity and upside, there are three primary ways to grow healthcare service revenue organically:

Increase provider utilization (i.e., number of patients seen per day/week) by increasing either patient demand and/or provider efficiency (i.e., so providers can see more patients per day)

Offer new or additional services to existing patients (i.e., increasing “same store sales”)

Open new clinics using free cash flow generated by the business (i.e., cash left after operating business, paying debt, maintaining minimum cash reserves, etc.) and maybe debt

PTs are beginning to offer additional, non-PT services to patients such wellness-coaching focused on supporting sleep, stress, movement, and/or nutrition-related needs. The market seems nascent (and forecasting it feels too speculative), so #2 above is excluded from this discussion.

Nevertheless, since opening new clinics is probably the riskiest and most lucrative, we’ll primarily focus there.

But, wait!

Prior to opening new clinics, I’d argue the focus should first be on increasing EBITDA at the business (two clinics) acquired in Part 1, specifically by increasing physical therapist utilization. To do so, my immediate priorities would be: 1) strategically increasing sales & marketing spend to acquire more patients and 2) increasing physical therapist hours available to see more patients per day.

We’ll discuss sales and marketing in the ‘Opening new clinics’ section below since it’s an even greater priority for those clinics (i.e., since they are starting with zero patients) and discuss increasing PT hours available now.

In Part 1, we mentioned how this business differentiates by providing a superior experience (i.e., 1-on-1, 45-minute sessions). This patient-focus is crucial to remember because many ways to increase PT hours available to see patients deprioritize the patient experience! These include:

Increasing hours of operation: Patients may not want to book appointments early in the morning or late at night.

Reducing time per visit: Patients may churn if they get less than 45 minutes with a PT.

Decreasing PT-to-Patient ratio: Patients may churn if their PT is now treating 2 or more others simultaneously.

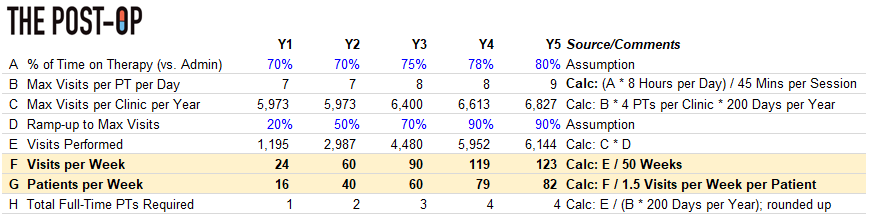

Thus, to increase PT hours available, we should focus on reducing PT time spent on administrative tasks, and here’s what the revenue growth opportunity looks like if daily time spent on admin is reduced from 2 to 1.6 hours (24 minutes saved daily).

Chart 1: Impact of reducing time spent on administrative tasks

More tactically, time could be saved on tasks such as:[4]

Documentation by investing in an EMR (like WebPT) and setting clear requirements on what does and does not need to be documented

Data review by having patient’s complete intake forms digitally and pre-loading relevant information on PTs’ iPads as needed

Scheduling by investing in a patient self-service scheduling portal and/or having the front desk (rather than PTs) manage appointment-related inquiries

Patient engagement by investing in tools like automated appointment reminders or providing PTs strategic marketing support

Even if additional demand is generated to fill the time, the total revenue growth opportunity (Row G) is still not overly material (less than ~5% lift per clinic) and thus probably shouldn’t be a huge priority.

Opening new clinics

Once the two clinics are humming with more demand and more efficient PTs, expansion becomes necessary to unlock the growth required to generate the entrepreneur and investors a return. However, rapidly opening new clinics can be troublesome for multiple reasons.

First, it’s challenging to maintain a certain level of quality when scaling quickly, which is particularly risky in an intimate business such as PT where patient experience is paramount to success. Thus, a more gradual roll-out of new clinics may be desirable.

Second, as Chart 2 below indicates, it takes time for new clinics to become EBITDA-positive (see the ‘New Clinic Pro Forma EBITDA’ tab in the model here). This timeline to profitability is an important nuance for an acquisition-minded entrepreneur that used debt financing as they must make mandatory debt payments and maintain certain liquidity metrics before lenders become concerned.

Chart 2: New clinic EBITDA forecast

Last, opening a clinic is operationally complex! You must find a space in a good location, furnish it (with furniture, equipment, etc.), secure permits, hire staff to run it, and more. Luckily, PT clinics do not involve major construction and will operate at a small scale, and thus are unlikely subject to state-level Certificate of Need (CON) laws. Other specialties, especially those performing surgeries in larger clinics, may need to consider state-level CON laws before opening new clinics.

Regardless, if overseeing the opening of new clinics, my top priorities would be as follows:

Demand Generation: How will the new clinic acquire patients?

Hiring PTs: How will the clinic hire new PTs in a tight labor market?

Affordability: If we figure out #1 and #2, do we have enough cash to finance new clinics openings?

Demand Generation

To generate and grow cash-paying patient demand, below is a strategy, largely informed by cash-pay PT expert Danny Matta, for doing so. I’d argue the approach is broadly applicable to growing various smaller-scale healthcare services.

Find niche(s): Insurance-only clinics often serve general orthopedic needs, so your PTs need to better serve the specific need of a patient to the point they are willing to pay cash. Each PT hired should find a specific niche relevant in that market (e.g., dancers, youth athletes) and focus solely on serving those patients. Finding niches could also potentially unlock B2B channels like becoming a ballet company’s PT on “retainer” during competitions.

Produce and distribute content: PTs differentiate by proving they are experts in their niche and can do so by producing/distributing niche-focused content via workshops, videos (YouTube, TikTok), blog posts and more. For example, I heard one women’s health-focused PT held a workshop for 8 female florists struggling with back pain from picking up buckets of water[5]. Becoming branded as an expert is critical to long-term success, but early-on, it requires increasing sales and marketing spend and takes PT time away from patients (reflected in Chart 3, Row A below).

Build relationships with patients[6]: Keeping sessions 1-on-1 is a key enabler, but PTs should also be trained to deeply understand the patient and their problem. A patient may say they want to alleviate back pain, but the PTs responsibility is to understand why they want to alleviate said pain (e.g., to play tennis pain-free). Nobody wants to spend time at PT, but if, for example, PT is viewed as a solution to their “tennis problem”, patients will be much more likely to come back for visits in the future.

How much demand is realistic? Chart 3 is my best guess, especially if the new clinic(s) are in the same geographic region and benefit from economies of density (i.e., benefits resulting from spatial proximity) like pre-existing brand awareness.

Chart 3: New clinic demand ramp

Hiring PTs

The healthcare service labor market is tight, and physical therapy is no different as a shortage of 27K PTs is expected by 2025[7]. Addressing this market dynamic is critical because failing to hire qualified PTs ultimately inhibits growth. Here’s how I’d try to convince PTs to join:

Compensation & Advancement: Offer above-market salaries and meaningful pay increases per-year with advancement opportunities like becoming the clinic manager someday.

Mission & Culture: Emphasize how the business is built around the patient as evidenced by the 1:1 PT to patient ratio and 45-minute sessions. Also, let PTs wear Lululemon to work each day!

Autonomy & Support: Empower PTs to choose their own niche(s) and make all therapy-related decisions in said niche but provide resources like video editors or content ghost-writers to make marketing themselves easier.

These tactics are also business model decisions that may drag down EBITDA in the short-term (due to higher costs), but if managed properly, should be investments that pay for themselves overtime.

Another labor-related factor to consider is economies of density. For example, if Clinic 3 is opened close enough to Clinic 1 or 2, PTs at Clinics 1 or 2 could spend a day serving patients at Clinic 3 as it ramps up. This comes at the expense of seeing patients at their “home” clinic but would help alleviate the labor shortage and avoid hiring an extra full-time, salaried PT before demand fully ramps up.

Chart 4: Economies of density analysis

As you can see, the net benefit of leveraging an existing PT is greater than hiring a second PT full-time (Row G vs. Row L). Taking advantage of economies of density becomes increasingly crucial as we consider the affordability of opening new clinics.

Affordability

In addition to mandatory debt payments (~$60K annually in this example) and physical therapist salaries, it requires additional $32K of cash upfront to launch a clinic big enough to scale up to for 4 PTs in a city like Nashville. See ‘Clinic Buildout Inputs’ tab in the model for more detail.

Chart 5: New clinic capital expenditures

The optimal new clinic launch plan balances debt payments and capital expenditures as well as the business’ existing cash balance with the time it takes new clinics to become profitable (Chart 2). For example, it may not be affordable to open multiple clinics in Y1 if the two newly acquired clinics have yet to generate enough cash to counterbalance the combination of negative EBITDA projected in Y1 from newly opened clinics, mandatory debt payments and clinic capital expenditures

Thus, we can create a few scenarios that fiddle with the timing of new clinic launches to see which most effectively maximizes EBITDA whilst maintaining a cash surplus.

Chart 6: New clinic launch plan

There are endless other scenarios to try, but for now, Scenario 3 is most effective at keeping the cash balance positive (Row K) while still meaningfully growing EBITDA (Row L). Check out ‘Valuation + Financing’ tab in the model for more detail on accompanying cash projections.

It’s also worth noting that this affordability challenge may be slightly exacerbated in this equation since the business we acquired is smaller and only generates $300K EBITDA. Said differently, a $2M EBITDA business would likely generate more cash flow thus could have an easier time financing its debt, new clinic losses, and capital expenditure requirements.

Pulling it altogether – 5-year forecast and returns analysis

Based on everything we discussed – demand ramp-up, hiring strategy, roll-out plan, etc. – I believe it’s reasonable to believe the business could grow to $6M+ in revenue and $900K+ in EBITDA, and both would continue to increase as newly opened clinics become more profitable over time (Chart 2).

Chart 7: Consolidated revenue and EBITDA forecast

If sold in Y5 at 4x EBITDA (i.e., same multiple at which it was bought) and after paying lenders and investors, the business would pocket the entrepreneur ~$750K.

Chart 8: Investor and acquisition-minded entrepreneur returns

Parting shot

Acquiring a larger business initially and/or extending the holding period beyond five years could create a more lucrative outcome, but my honest reaction while writing this was that the organic growth strategy carries too much execution risk to only return $750K to the entrepreneur after five years.

This was only one (albeit nuanced) example, but regardless, I hope it provides a framework for thinking through organic growth in healthcare services and maybe sparks some ideas for acquisition-minded entrepreneurs in the process.

**

Links to: Sources | Analysis (Excel) | Graphics (PPT)

If this topic interests you in any capacity (investor, entrepreneur, etc.), please feel free to reach out on to me on Twitter @z_miller4 or connect with me on LinkedIn here!