Part 1: So you want to buy a healthcare service business...

The bull and bear case, attributes of attractive subsectors, and acquisition nuts & bolts

Season 3’s teaser defined what we mean by buyouts, healthcare services businesses, private equity, and acquisition-minded entrepreneurs. I’d recommend checking it out so we’re on the same page.

The bull and bear case for healthcare service buyouts

Anecdotally, even in the current downturn, digital health, a catch-all term for tech-enabled service and SaaS companies in healthcare, still seems like the sexy area for employment or investment in healthcare. In theory, compared to traditional, brick-and-mortar healthcare services, being technology-driven, among other benefits, creates the possibility for greater and faster scale and with it comes larger potential returns.

I am not arguing against working or investing in the digital health, but instead questioning whether it has led us to overlook another opportunity with significant return potential and arguably less risk.

The bull case for healthcare service buyouts

I’ve attempted to distill why I am bullish on acquiring healthcare service businesses. especially in comparison to working or investing in early-stage digital health, down to three reasons:

Simpler business model and value proposition: At their core, healthcare service businesses employ providers that deliver care to patients in turn for payment from patients or their payers. In healthcare, such simplicity makes going to market easier. Conversely, digital health solutions often need to convince customers of their product’s value, taking shape in the form of long sales cycles or pilots with no guaranteed long-term contract. Navigating this bureaucracy to prove value can be costly, time-consuming, and unpredictable.

Ability to capture patient trust: The 2022 Rock Health Consumer Survey found 77% of consumers “trust” doctors as a source of healthcare information while only 28% “trust” digital health apps. I believe trust will ultimately trump convenience in most situations, and what better way to build trust with patients than by forming relationships with them via in-person interactions in a clinic or at their home.

Likelihood of liquidity event: To even earn a return on equity (as an employee or investor), you need a liquidity event (e.g., an acquisition), and to be acquired, you need willing buyers. As of Q3 2022, there were nearly 600 PE healthcare services buyouts[1] compared to only 144 digital health deals[2]. Further, healthcare service business “holding periods” or the time required to hit the thresholds needed to be ready for sale (i.e., oftentimes $25M+ revenue or $5M+ EBITDA depending on starting size) is around 5 years[3]. The comparable threshold for digital health companies is $100M annual recurring revenue (ARR) and on average, it takes 10 years for tech-enabled service or SaaS companies in healthcare to get there[4]. Size of returns obviously differ, but a more likely and sooner liquidity event is quite valuable.

The bear case for healthcare service buyouts

There are also legitimate risks when acquiring a healthcare service business, especially as an acquisition-minded entrepreneur, such as:

Reimbursement: What if the business never reaches the scale required to gain bargaining power with payers and they materially decrease reimbursement rates?

Competition: What if the hospital in the business’ geography starts prioritizing its area of specialty care and begins referring in-house more aggressively?

Labor: What if healthcare’s labor shortage gets worse and it becomes too expensive or difficult to hire the care providers needed to expand?

Debt-Induced Distress: What if, when acquiring the business, you take on too much debt at too high of an interest rate and then some of the what-ifs above come true (see: KKR & Envision bankruptcy)?

Note I also purposefully omitted common concerns when private equity acquires and attempts to rapidly grow a healthcare service business (e.g., shady billing practices, deterioration of quality, etc.).

Attributes of attractive healthcare subsectors for buyouts

Acquiring a healthcare business in sectors with certain attributes can reduce the likelihood of the above ‘what-ifs’ and make growing the business a bit easier. Below are my Top 5 attributes to consider when picking subsectors:

Chart 1: Top 5 attributes of subsectors attractive for buyouts

#1: Cash-Paying Customers

Why?: Insurance increases the total addressable market for a healthcare service, but adds administrative expenses for documentation and billing and creates reimbursement risk if payers like Medicare materially lower rates. Cash-pay also minimizes working capital-related risks.

Example: Many physical therapy clinics are at least hybrid cash-pay and charge around $200 per session.

#2: Re-occurring Customers

Why? Re-occurring customers keep revenue (and cash flow) more consistent and do not require the business to constantly spend on marketing to acquire new customers.

Example: Patients with chronic pain may visit their physical therapists 1-2 times per week for a year or more.

#3: Fragmented Local Market

Why?: Without a dominant player, businesses can acquire market share by capturing a niche. Fragmentation also presents an opportunity to grow via consolidating with small businesses providing the same service.

Example: Physical therapy requires different specializations (e.g., orthopedic, neurological) or niches (e.g., dancers, runners) and in turn has become a fragmented market with no one player holding more than 3%[5].

#4: Low Capital Expenditure (CapEx) Requirements

Why? This attribute is most relevant for buyers like acquisition-minded entrepreneurs with more limited access to capital. Since the business was acquired with debt, excess cash flow should be used for debt payments and thus can limit cash available to invest in growth.

Example: Opening a physical therapy clinic can be fairly inexpensive with the costliest elements being rent and equipment like treatment tables and treadmills.

#5: Growing Local Market

Why? Stating the obvious but acquiring a business in an expanding market means you have more potential customers and therefore greater growth potential.

Example: Physical therapy for obesity management might be growing overall, but growth looks very different in New York City where people are more active compared to like Memphis where obesity is prevalent.

Lastly, at the company-level, I’d also consider specific financial characteristics (e.g., total revenue, EBITDA margin) and owner-related characteristics (e.g., willingness to sell), but for now, these five attributes are meant to help identify certain healthcare services well-suited for buyouts.

Acquisition nuts & bolts

Physical therapy (PT) checks a lot of boxes (not perfectly, but good enough), so an illustrative PT business will be our buyout “target” and used to explain key concepts the rest of Season 3.

Before we buy the business, here are the baseline, working assumptions that are based on various sources in the cash-pay PT space:

Clinics: The PT business owns 2 clinics, each with 4 full-time physical therapists (PTs) and 1 front-desk admin handling check-in, scheduling, billing, etc.

Price: Each session costs $175.

Utilization: Each clinic operates at ~75% utilization combined across all 4 PTs (i.e., PTs performing 6 out of a maximum 8 sessions per day).

Patient Experience: PTs deliver therapy via 1-on-1, 45-minute sessions (i.e., not a PT “mill”).

Payment: Hybrid cash-pay and insurance. All patients pay in cash up-front, and as needed after the fact, clinic can submit claim to payer and reimburse patient for amount received from payer.

Financial Performance: Combined, the two clinics generate $1.7M in revenue and $300K EBITDA.

Additional assumptions and key calculations can be found in the ‘TargetCo Model’ section of the analysis here.

Valuing the business

Bear me with me as we leave the healthcare universe for a moment and take a jaunt down Wall Street.

To determine the amount of capital required to perform the buyout, you first need determine the purchase price. I’ve never been a ‘financial buyer’, so my answer may be more academic than practical, but here’s a simple methodology:

Chart 2: Purchase price calculation

The Purchase Price-to-EBITDA multiple (a.k.a. Purchase Price multiple) is based on the multiples used to value companies of similar size and/or in similar industries. Businesses like this generating less than $1M EBITDA are most likely to command a Purchase Price multiple of 3-5x[6]. Acquisition-minded entrepreneurs also commonly consider companies between $1-5M of EBITDA, and healthcare service businesses that size typically command Purchase Price multiples of 5-7x (or higher) with multiples increasing based on company size and PE activity in the space.

Ultimately, finalizing both EBITDA and the multiple used to calculate the purchase price requires a lot of back and forth with the seller.

Structuring the transaction

Structuring the transaction means determining the appropriate amount of debt versus equity to use to finance (i.e., pay) the purchase price. Concurrently to negotiating the purchase price with the seller, acquisition-minded entrepreneurs are also talking to lenders and investors, pitching them on the target company and seeing how much capital each party is willing to provide.

Debt: Using debt (a.k.a. leverage) to finance the purchase price creates significant additional upside (and downside) for the buyer. Chart 3 shows a simple example how the value of equity can change with leverage. If the value of the business grew from $100 to $110 (upside scenario), equity increases by 50% ($20 to $30) if financed with debt compared to only 10% if financed without debt ($100 to $110). The inverse holds true if the value of the business drops from $100 to $90 (downside scenario).

Chart 3: Upside & downside by leverage

Leverage comes with risk because of this downside as well as debt payment requirements, so finding the optimal amount of leverage is important. Nevertheless, acquisition-minded entrepreneurs typically finance between one-half to two-thirds of the purchase price (if not more) for such acquisitions with debt[7]. Financing a deal with a 4x Purchase Price multiple with 50% debt means the Debt-to-EBITDA multiple would be 2x (i.e., 2x divided by 4x)

This amount of debt is most likely provided via a term loan from the bank and/or a “seller note” where the seller accepts a portion of the $1.2M purchase price via deferred, interest-bearing payments. In acquisitions where Purchase Price multiples are higher and therefore even more debt financing is required, additional lenders willing to take greater risk may be required to provide debt in addition to the term loan and seller note.

This is all just scratching the surface on debt, but I hope it’s helpful. If interested, check out this link for a helpful graphic on the different types of debt used in transactions like these.

Equity: Once you’ve aligned on a purchase price with the seller and secured the debt financing from the bank, seller, and other lenders as needed, the remaining difference between the purchase price and debt must be filled with equity! An acquisition-minded entrepreneur would need to raise this amount from their own savings or from investors (i.e., either friends/family or firms like Pacific Lake Partners) in exchange for ownership in the acquired business, usually around 70-75% in total.

Chart 4 illustrates how purchase price, debt, equity, and some other nuances (i.e., fees, cash requirements) intertwine and finalize the transaction structure.

Chart 4: Transaction structure calculations

Growing the business & creating value

To pay off the newly acquired debt whilst generating a return for your investors, you need to grow the business and sell it for more than you bought it (obviously!) by either:

Growing revenue

Selling at a higher EBITDA multiple

Expanding EBITDA margin

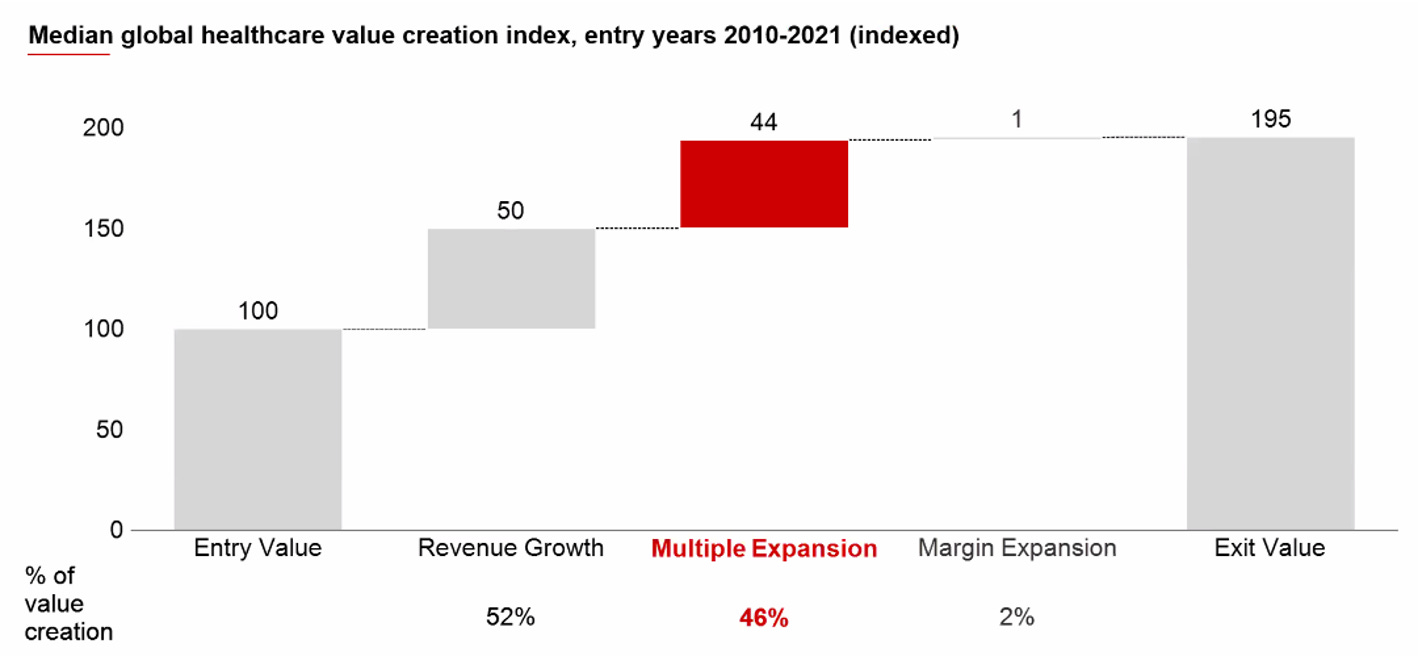

The chart from the Bain Healthcare Private Equity and M&A Report below illustrates how basically all valuation creation (i.e., the difference between entry and exit values) comes from #1 and #2.

Chart 5: Healthcare private entry value to exit value bridge

Revenue growth at a PT clinic could be organic (i.e., opening clinics, increasing sales at existing clinics and/or with existing customers) or inorganic (i.e., acquiring clinics), and if revenue and/or EBITDA grows beyond a certain threshold, the business may command a higher Purchase Price multiple at exit than it did at entry (i.e., multiple expansion).

Since 50% of value creation comes revenue growth and since revenue growth largely drives multiple expansion, revenue growth strategies within healthcare service businesses are where we’ll focus the rest of the season. More specifically, Parts 2 and 3 will tactically and critically explore organic and inorganic revenue growth strategies from the perspective the illustrative PT business we bought for $1.2M. Stay tuned!

Parting shot

Healthcare service buyouts can get a bad wrap-up for various reasons and I acknowledge the underlying for-profit motive has been much-maligned. Looking far beyond this over-debated topic, I hope Season 3 of The Post-Op sheds light on the opportunity buyouts can provide healthcare entrepreneurs and give all practitioners a better understanding of how it all works and why.

**

Links to: Sources | Analysis (Excel) | Graphics (PPT)

If this topic interests you in any capacity (investor, entrepreneur, etc.), please feel free to reach out on to me on Twitter @z_miller4 or connect with me on LinkedIn here!