Deleted Scenes: What about franchises?

A potentially overlooked opportunity at the intersection of building and buying

Why you should keep reading

Let’s start by calling a spade a spade. Franchising can have a sketchy connotation, so I understand you’re already feeling disinterested. My attempted hook to keep you reading is this – if you had the opportunity to buy a healthcare service business with an established brand, proven business model, operational expertise, and economies of scale benefits, would you at least consider it? If the answer is yes (which it should be), then hopefully this discussion will be worthwhile.

What is a franchise?

The technical definition for a franchise, as stated in FTC Rule 436, is a business that allows franchisees to use its name or trademark, provides significant operating assistance or exercises significant control over franchisees, and collects a fee (e.g., upfront franchise fee, royalty fee, etc.)[1].

The basics of the franchisor-franchisee relationship are highlighted below.

Chart 1: Franchisor-franchisee relationship

Chart 1 is industry-agnostic, but some healthcare service franchises claim to support payer relations (i.e., adding your franchise to their provider networks) and revenue cycle (e.g., benefits verification, billing). In addition, “training” likely covers the franchisor’s perspective on how best to treat patients. Sadly, not all franchisors will provide the support they will claim to provide, so it is critical to validate any claims by talking to existing franchisees.

With that context, let’s dive into the franchise landscape in healthcare services.

Healthcare service franchises

By my count and largely informed by the recently launched Krokit franchise database, I found 150+ healthcare service franchises.

Not all 150 fit in a market map (surprising!), so Chart 2 below highlights the most prolific (based on number of location) within each sector. I acknowledge some sectors (e.g., Specialty Care, “Wellness” Therapies) have broader definitions than others, but this was my best attempt at categorization.

Nevertheless, if interested, the entire listing of healthcare service franchises can be found here.

Chart 2: Healthcare service franchise market map[2]

Some quick, clarifying definitions of ambiguously titled sectors:

Physical Therapy – Non-Traditional: Services to help you manage pain via less traditional methods such as acupuncture, salt therapy, laser therapy, and more.

Mental Health – Other: Catch-all bucket for non-therapy or learning difference mental health services like guided meditation, brain training, and substance abuse treatment.

Specialty Care: Delivery of non-primary care services such as dentistry, audiology, hospice care, lice treatment (!), and applied behavior analysis therapy (ABA).

“Wellness” Therapies: Trendy treatments that aren’t necessarily clinically proven such as IV hydration therapy, red light therapy, cryotherapy, and infrared saunas.

Key franchise metrics by sector

Franchises disclose more publicly available information than you might think. Franchisors are required to provide a Franchise Disclosure Document (FDD) to prospective franchisees that includes an overview of the business, financial opportunity, and more. If franchisors are registered in California, Minnesota, or Wisconsin, you can find FDDs online at no cost.

Leveraging FDD data (from Krokit), we’ll attempt to answer the five questions to better understand the healthcare service franchise landscape and uncover promising opportunities in the process:

Which sectors have the most competition?

Which sectors are in the Goldilocks Zone and have just the right number of locations?

Which sectors require the largest investment to open a location?

Which sectors have the greatest revenue potential?

Which sectors are most profitable after accounting for all costs and fees?

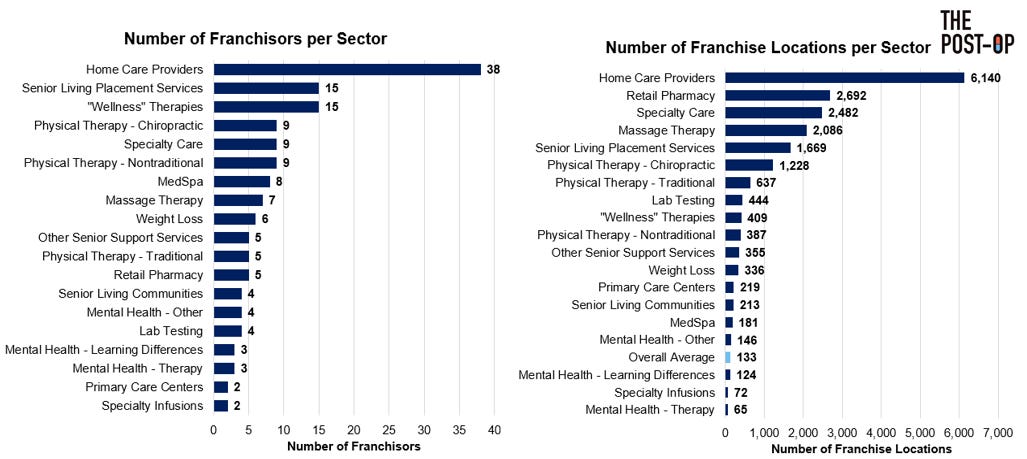

Competition

The number of franchisors is an indicator of where competition can increase the quickest in the future as the more franchisors in a sector, the quicker new franchise locations can be opened. Conversely, the number of franchise locations is also important because if there are more locations in a sector, then the best territories are likely already owned by one or multiple franchisors, making it harder to build a viable business. Thus, both franchisor and franchise locations should be considered to get a holistic perspective of the competitive landscape.

Chart 3: Number of franchisors and franchise locations per sector

Goldilocks Zone

Finding a good franchise opportunity is not as simple as looking at the sectors with the least competition. Franchises enter a “Goldilocks Zone” when the franchisor does not have too many or too few locations and that is most optimal time to open a new location. Anecdotally, I have heard the Goldilocks Zone is around 50 locations[3] because it provides enough evidence that the franchise model can work, but potentially lucrative territories are still available to franchisees.

We’re identifying the Goldilocks Zone at the sector-level as an initial proxy, but you’ll want to look at the franchisor-level to properly conclude whether a specific franchisor is in the Goldilocks Zone.

Chart 4: Average number of locations per franchise per sector

Initial Investment

Thus far, we’ve analyzed the market, but financial projections are the other (and probably more important) element to consider. That starts with understanding the estimated capital required to open a franchise location. There’s no Goldilocks Zone for the initial investment, but I do have a couple of thoughts to consider:

Acquiring vs. Opening: If bullish on a certain market but concerned about breaking even since you are starting from scratch, then maybe consider buying an existing location rather than building a new one. It’s probably more expensive, but arguably less risky since you are acquiring a cash-flowing business with an existing customer base and less CapEx requirements.

Capital as a Barriers-to-Entry: Sectors with higher investment requirements also then naturally have higher barriers to entry. For example, it might cost $250K+ more to open a Med Spa than a “Wellness” Therapy Clinic, but that additional $250K could make opening a Med Spa cost-prohibitive to many prospective franchisees and thus limit competition to point that the $250K pays for itself over time.

Chart 5: Average initial investment required per sector

FDDs typically provide a range of the expected investment required for a franchisee to build and open a new location.

Annual Revenue Potential

I’m willing to say annual revenue potential per location is singlehandedly the most important metric to consider. If we assume a 15% EBITDA margin and a 4x Purchase Price-to-EBITDA Multiple, then only in the top three sectors would a single location generate a $1M+ valuation (on average). That means, as a franchisee in all other sectors, you’d have to open at least two locations to generate a seven-figure return. Not only is this expensive, but by the time you choose to open a second location, the franchisor could be long gone from the Goldilocks Zone and a riskier proposition than when you opened the first location.

Chart 6: Average revenue per franchise per sector

I will caveat that the top three sectors represent a limited sample size – Specialty Infusions, Lab Testing, and Primary Care Centers only have two, four, and two franchisors respectively. Refer to Chart 3 for more data on that front.

All-in Profitability

Long story short, I made-up a metric called “All-in Profitability’ as a sanity check to ensure hidden fees weren’t making the annual revenue potential misleading. The “All-In Profitability” metric = Average Annual Revenue – (Average Investment + Average Franchise Fee + (Average Royalty Fee * Average Revenue).

First, here is what Franchise Fees and Royalty Fees look like at the sector-level.

Chart 7: Average fees (franchise + royalty) per sector

Below is the “All-in Profitability” per sector, and as you can see, Franchise and Royalty Fees shouldn’t don’t change our sector-level perspective much! The top two sectors in terms of revenue potential – Specialty Infusions and Lab Testing – are also atop my made-up metric.

Chart 8: Average “all-profitability” per sector

Realistically, you can’t look at any of the above charts in a silo and draw a definitive conclusion on where the “best” healthcare service franchise opportunity exists. Initial investment matters in the context of revenue opportunity, and the future revenue opportunity at least partially depends on the state of the competition and a given franchisor.

For example, just because Home Care Providers have the third highest “All-In Profitability” doesn’t make it a good investment. Remember there are already over 6,000+ locations spread across 38 franchisors, meaning it’s no guarantee the next location can replicate the success of the first 6,000+.

Things I like and don’t like about healthcare service franchises

The above analysis was hopefully first of its kind and provides a clearer picture into the current state of healthcare service franchising opportunities. Before wrapping, I want to zoom out and discuss what I do/don’t like about franchises in the context of running healthcare service businesses.

Things I like

Opportunities in rural care: As competition for patients in metropolitan areas increases, franchising could become an interesting model for distribution of care in more remote settings. Compared to a solo physician opening a rural clinic, it’s lower risk since the franchisee is theoretically given the infrastructure needed to start a clinic more easily. Compared to an entity like Oak Street opening a rural clinic, it’s lower risk since the franchisee, not the franchisor, bears the upfront cost.

Potentially value-additive royalty fees: Many believe opening is a bad idea because of the obligation to pay X% of revenue to the franchisor, but I’m here to tell you, especially in healthcare, that is short-sighted. As outlined in Chart 7, royalty fees in healthcare services are most often below 10% and while you’ll want to diligence this, there are franchisors that provide healthcare-specific administrative support for functions like payer relations and revenue cycle. We hear how administrative expenses account for 15-30% of all healthcare spend[4] and thus 10%+ of revenue if you do the math. Thus, with the right franchisors, royalties can be value additive as they save both the cost of building and scaling costly administrative functions.

Weakening of existential threats facing entrepreneurial providers: Outsourcing admin obviously greatly reduces the barriers to starting a new practice. However, if I was starting an independent practice, my deepest fear would be the risk of getting squeezed in rate negotiations by payers (rather than getting revenue cycle right). Franchising sort of addresses this fear because each franchisee immediately benefits from the scale of the broader franchisee (i.e., provider) network in rate negotiations.

Things I don’t like

The unknown with telemedicine: Identified franchises seem most focused on delivering services at home or in a clinic. Especially in Primary Care, Specialty Care, and Mental Health, telemedicine can be a valuable component and a key enabler of distributing care to remote settings. Thus, as virtual-based services become more necessary and common, it is unclear how it will fit into the legacy franchise model where franchisees are allocated physical territories in which they can deliver their service. My concern is this gray area could limit the utilization of telemedicine by these franchises overall and potentially makes it harder for them to compete.

Healthcare-specific downside risks: Franchisees often have much of their personal wealth tied up in their franchise, so if the franchise is struggling, the franchisee feels great pressure to make it profitable. This risk is present across all franchises, but in healthcare services, that could lead to actions to increase profitability like performing unnecessary treatments, overworking providers, ignoring safety protocols, etc., all of which have negative consequences for patients and providers. Said differently, a healthcare service franchise gone wrong has much more severe implications than a Subway or Domino’s gone wrong.

Snake oil-y: By my count, there are 15 franchisors of “Wellness” Therapies (defined above), 9 of Chiropractic Therapy, and 9 of Non-Traditional Physical Therapy (also defined above). Together, they comprise 20%+ of the 150+ franchisors identified, which means more than one-fifth of healthcare services franchises provide services not clinically proven to be effective.

Parting shot

No parting shot today since this a bonus article. I hope you enjoyed Season 3!

**

Links to: Sources | Graphics – Market Map, All Other Charts

If this topic interests you in any capacity (investor, entrepreneur, etc.), please feel free to reach out to me on Twitter (X?) @z_miller4 or on LinkedIn here. If you are particularly interested in the dataset I used to perform this analysis, please feel free to reach out as well.